Mortgage rates play a significant role in determining how much home you can afford. These rates influence the cost of borrowing money for your mortgage, which directly impacts your monthly payment and, ultimately, your home buying power.

Mortgage rates play a significant role in determining how much home you can afford. These rates influence the cost of borrowing money for your mortgage, which directly impacts your monthly payment and, ultimately, your home buying power.

The Impact of Mortgage Rates on Affordability

When mortgage rates are low, the cost of borrowing decreases. This means you can afford a larger loan or purchase a more expensive home without substantially increasing your monthly payment. For example, a lower rate might allow you to upgrade to a home with additional square footage, a better neighborhood, or extra features that would otherwise be out of reach.

On the other hand, when mortgage rates rise, your purchasing power decreases. Higher interest rates mean higher monthly payments, which may require you to adjust your budget or consider less expensive properties. Even a small increase in rates can significantly affect affordability. For instance, a 1% rise in rates could reduce the loan amount you qualify for by approximately 10%.

Timing is Key

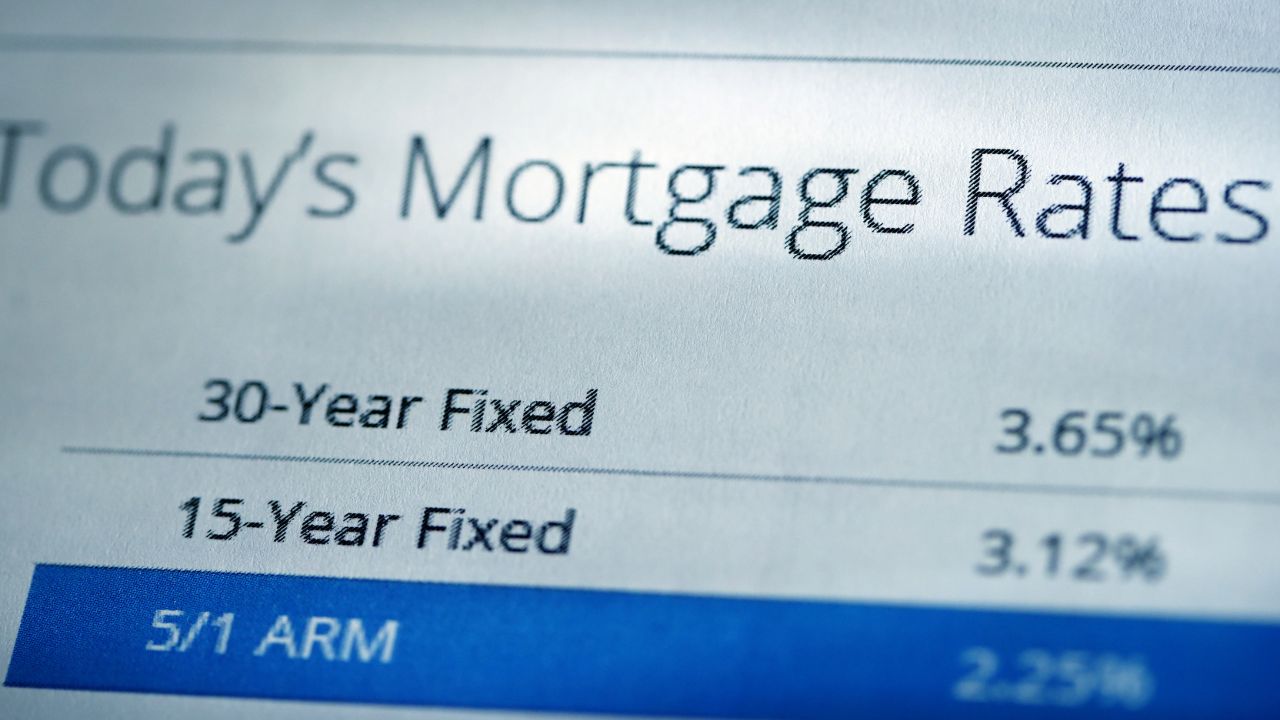

Mortgage rates fluctuate based on various factors, including the economy, inflation, and Federal Reserve policies. While it’s impossible to predict the exact movements of rates, staying informed about trends can help you make smarter financial decisions.

Locking in a rate when they are favorable can save you thousands over the life of your loan. If rates are expected to rise, acting sooner rather than later could maximize your home buying power. Conversely, if rates are stable or expected to decrease, you might benefit from waiting or negotiating better terms.

The Value of Professional Guidance

Understanding mortgage rates and their implications can be overwhelming, but you don’t have to navigate it alone. A mortgage professional can:

-

Analyze market trends and provide insight into rate fluctuations.

-

Explain how different rates impact your monthly payment and loan costs.

-

Help you develop a strategy to secure the most advantageous terms for your situation.

Partnering with an experienced professional ensures you’re making informed decisions and taking full advantage of the opportunities available to you.

Tips to Maximize Your Buying Power

To make the most of your home buying journey, consider these strategies:

-

Boost Your Credit Score: Lenders offer the best rates to borrowers with strong credit.

-

Increase Your Down Payment: A larger down payment reduces the loan amount and can qualify you for better rates.

-

Compare Lenders: Shopping around can reveal competitive offers and lower rates.

-

Plan Strategically: Work with your mortgage professional to determine the best time to act based on market conditions.

Mortgage rates significantly influence how much home you can afford, making it essential to understand their impact. By staying informed, timing your purchase wisely, and working with a trusted mortgage professional, you can maximize your home buying power and achieve your homeownership goals.

Have questions about mortgage rates and how they affect your buying power? Contact us today to get personalized guidance and take the next step toward your dream home.