Buying a home in a remote area can be a dream come true—peaceful surroundings, open spaces, and a slower pace of life. However, securing a mortgage for these properties comes with unique challenges. As a mortgage originator, I’m here to break down the hurdles and offer solutions so you can make your rural homeownership dreams a reality.

Buying a home in a remote area can be a dream come true—peaceful surroundings, open spaces, and a slower pace of life. However, securing a mortgage for these properties comes with unique challenges. As a mortgage originator, I’m here to break down the hurdles and offer solutions so you can make your rural homeownership dreams a reality.

Challenges of Securing a Mortgage in Remote Areas

- Limited Lender Availability

- Many traditional lenders hesitate to finance rural properties due to lower housing demand, unique appraisal difficulties, and the risk of market fluctuations.

- Higher Interest Rates & Stricter Requirements

- Lenders may charge higher interest rates or require a larger down payment to mitigate perceived risks in remote areas.

Appraisal Complexities

Since rural properties have fewer comparable sales (“comps”), appraisers may struggle to assess an accurate market value, potentially affecting loan approvals.

Property Restrictions

Some remote homes may be off-grid, lack traditional utilities, or sit on large plots of land—factors that can disqualify them from conventional loan programs.

Accessibility & Infrastructure Issues

Lenders consider road access, emergency services, and property maintenance when evaluating loans. If a home is too isolated or lacks year-round access, it may impact eligibility.

Solutions & Mortgage Options

- USDA Loans – A great option for eligible buyers in designated rural areas, offering 100 percent financing and low-interest rates.

- FHA Loans – While typically used in suburban and urban areas, FHA loans can work for remote properties as long as they meet HUD requirements.

- VA Loans – Eligible veterans can secure zero-down loans for rural properties, provided the home meets VA appraisal standards.

- Portfolio Loans – Some smaller banks and credit unions offer in-house lending solutions for unique rural properties.

- Construction Loans – If you’re building in a remote area, construction-to-permanent loans can finance both the land and the home.

- Seller Financing – In cases where traditional financing is challenging, negotiating directly with the seller may be an option.

While financing a home in a remote area comes with challenges, the right mortgage strategy can open doors to your dream home. Working with an experienced mortgage professional ensures you explore all available options and secure the best possible loan.

Thinking about purchasing in a remote area? Let’s connect and discuss the best mortgage solutions for your needs.

If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage.

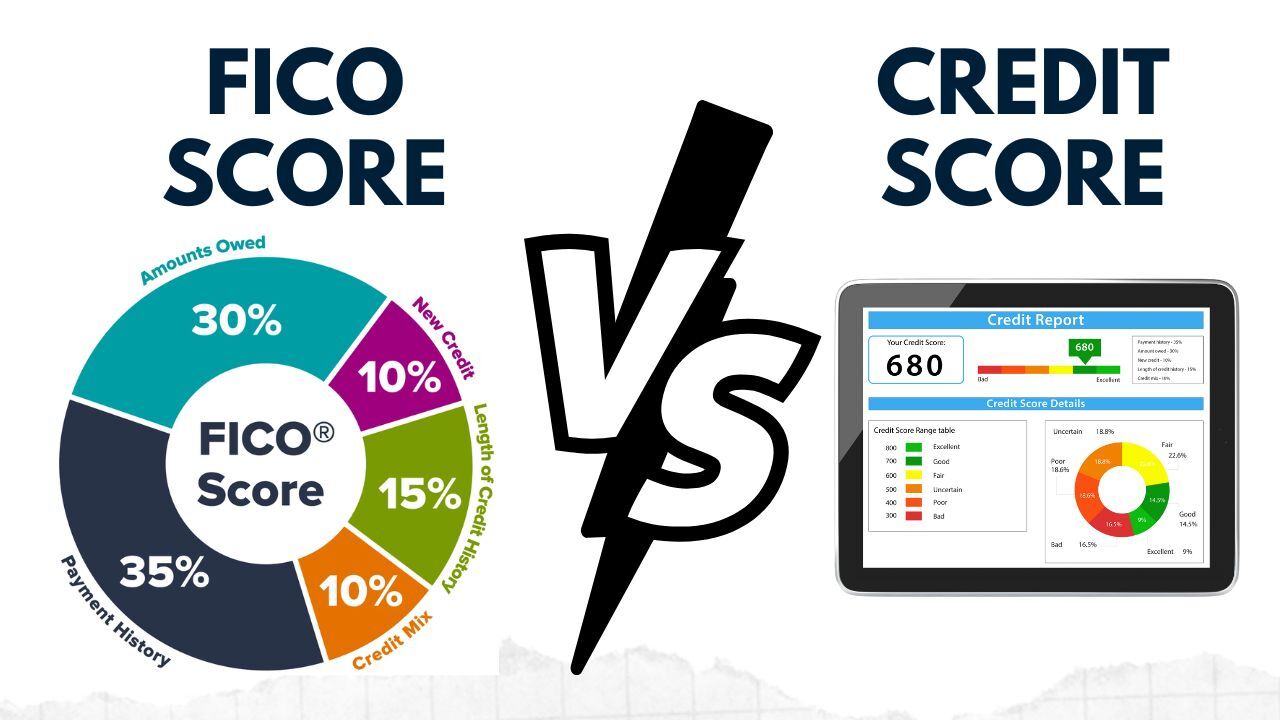

If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage. When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.

When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences. Securing a mortgage as a self-employed professional can be more challenging than for traditional W-2 employees, but with the right preparation and documentation, it is entirely achievable. Here’s a guide to help you navigate the process:

Securing a mortgage as a self-employed professional can be more challenging than for traditional W-2 employees, but with the right preparation and documentation, it is entirely achievable. Here’s a guide to help you navigate the process:

The previous week had the Federal Reserve making their first rate decision since the Trump administration had taken office. With many uncertainties about the current direction of things, the Federal Reserve had decided there would not be any change necessary to the current rates. Stating that the current inflation and economic conditions have largely been a result of the Trump administration’s policies on tariffs. Chairman Powell has been strongly dovish at this point, stating they would need to “see how things actually work out.” There were a slew of other minor data releases but none were far reaching in their impact on the economy and current direction of things.

The previous week had the Federal Reserve making their first rate decision since the Trump administration had taken office. With many uncertainties about the current direction of things, the Federal Reserve had decided there would not be any change necessary to the current rates. Stating that the current inflation and economic conditions have largely been a result of the Trump administration’s policies on tariffs. Chairman Powell has been strongly dovish at this point, stating they would need to “see how things actually work out.” There were a slew of other minor data releases but none were far reaching in their impact on the economy and current direction of things. Purchasing a home in the U.S. as a non-U.S. citizen is entirely possible, but the process comes with unique requirements and considerations. Whether you are a permanent resident, temporary visa holder, or foreign national, understanding the available mortgage options can help you navigate the path to homeownership successfully.

Purchasing a home in the U.S. as a non-U.S. citizen is entirely possible, but the process comes with unique requirements and considerations. Whether you are a permanent resident, temporary visa holder, or foreign national, understanding the available mortgage options can help you navigate the path to homeownership successfully. For homeowners facing temporary financial hardship, mortgage payment deferral programs can provide much-needed relief. These programs allow borrowers to pause or reduce their monthly mortgage payments for a specific period, helping them avoid foreclosure while stabilizing their finances.

For homeowners facing temporary financial hardship, mortgage payment deferral programs can provide much-needed relief. These programs allow borrowers to pause or reduce their monthly mortgage payments for a specific period, helping them avoid foreclosure while stabilizing their finances. When you take out a mortgage, you commit to a long-term financial obligation. Understanding mortgage amortization can help you make informed decisions about your loan and how your payments impact your financial future.

When you take out a mortgage, you commit to a long-term financial obligation. Understanding mortgage amortization can help you make informed decisions about your loan and how your payments impact your financial future.