Introduction

Buying your first home can be an exciting but overwhelming experience. One of the most crucial steps is speaking with a loan officer who can guide you through the mortgage process. Asking the right questions can help you understand your options and ensure you’re making informed decisions. In this post, we’ll focus on the top four questions that first-time home buyers frequently ask loan officers.

1. What Types of Loans Are Available to Me?

Understanding the different loan options available can help you choose the best one for your financial situation. Common loan types include:

- Conventional Loans: Not insured by the government, usually requiring higher credit scores and larger down payments.

- FHA Loans: Insured by the Federal Housing Administration, these loans are ideal for first-time buyers with lower credit scores and smaller down payments.

- VA Loans: Available to veterans and active-duty military personnel, offering competitive rates and often requiring no down payment.

- USDA Loans: Designed for rural home buyers, these loans offer low interest rates and no down payment requirements.

Follow-Up Questions:

- Which loan type best fits my financial situation?

- What are the specific eligibility requirements for each loan type?

- Are there any special programs or incentives for first-time home buyers?

2. What Will My Interest Rate Be?

Your interest rate will significantly impact your monthly mortgage payments and the total cost of your loan. It’s essential to understand how your rate is determined and whether it can change over time.

Follow-Up Questions:

- How is my interest rate determined?

- Are there ways to lower my interest rate?

- Can I lock in my interest rate, and if so, for how long?

3. What Are the Closing Costs?

Closing costs are fees associated with finalizing your mortgage and can range from 2% to 5% of the loan amount. Knowing what to expect can help you budget accordingly.

Follow-Up Questions:

- What specific closing costs will I be responsible for?

- Can any of these costs be negotiated or waived?

- Are there any lender credits available to help cover closing costs?

4. How Much Down Payment Is Required?

The down payment is a crucial part of the home buying process, affecting your loan-to-value ratio and mortgage terms. Understanding your down payment requirements can help you plan your finances better.

Follow-Up Questions:

- What is the minimum down payment required for this loan?

- Are there any down payment assistance programs available?

- How will my down payment amount affect my mortgage terms?

Conclusion

Asking these top four questions can provide you with a solid understanding of your mortgage options and help you make informed decisions. A good loan officer will be happy to answer your questions and guide you through the process. For personalized advice and to explore your mortgage options, contact Coleen TeBockhorst at Bay Equity Home Loans. Our team is here to help you achieve your homeownership dreams in Minneapolis.

Contact Information:

- Phone: 612-701-8512

- Email: Coleen@ColeenTeBockhorst.com

- Website: Bay Equity Home Loans

- Facebook: Coleen TeBockhorst

Call to Action

Stay informed and make the best investment decisions by following our blog and social media channels. Don’t forget to share this post with friends and family who might benefit from these essential questions to ask a loan officer as a first-time home buyer!

Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation.

Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation.

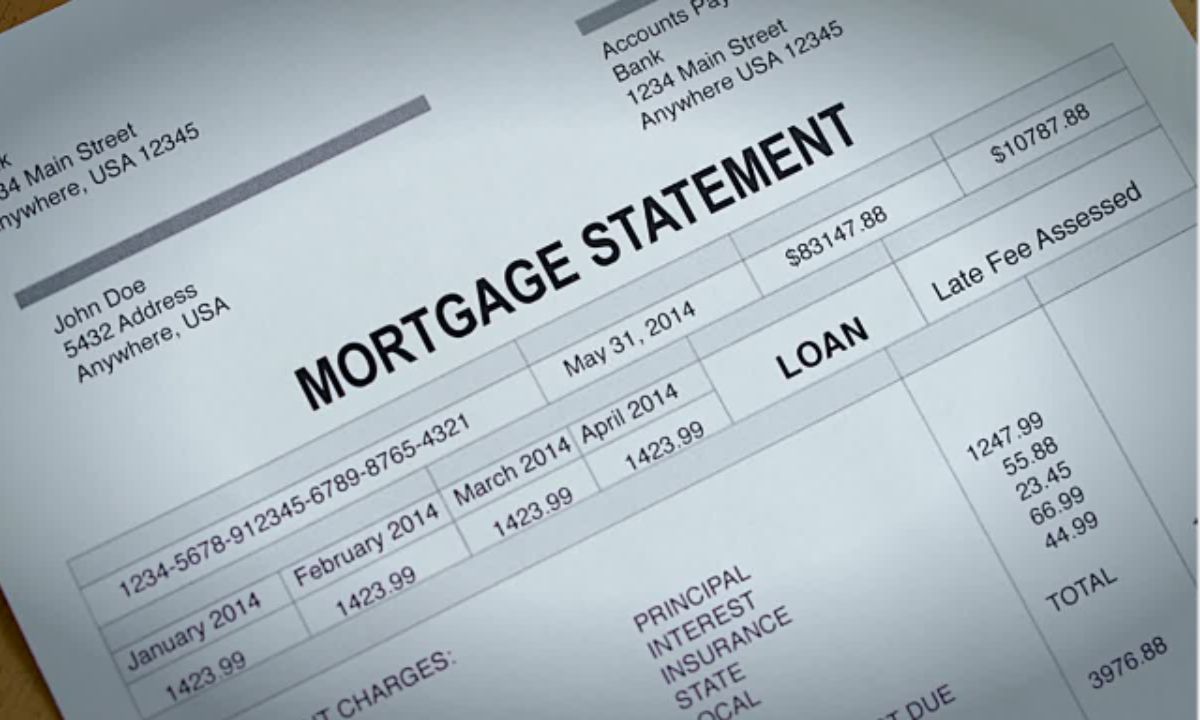

Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when reading your mortgage statement, what to look for, and how to verify its accuracy.

Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when reading your mortgage statement, what to look for, and how to verify its accuracy. When it comes to buying a home, you will find many mortgage options available. One of the lesser-known but potentially advantageous choices is the Graduated Payment Mortgage (GPM). Let’s discuss what GPMs are, how they work, and how they differ from other mortgage options.

When it comes to buying a home, you will find many mortgage options available. One of the lesser-known but potentially advantageous choices is the Graduated Payment Mortgage (GPM). Let’s discuss what GPMs are, how they work, and how they differ from other mortgage options.

With various regulations and guidelines to follow, it’s crucial to understand the role of the U.S. Department of Housing and Urban Development (HUD) in this landscape. HUD plays a vital role in regulating mortgage lending practices to ensure fair and equitable access to housing. In this blog post, we’ll delve into the functions of HUD and how they impact mortgage lending practices.

With various regulations and guidelines to follow, it’s crucial to understand the role of the U.S. Department of Housing and Urban Development (HUD) in this landscape. HUD plays a vital role in regulating mortgage lending practices to ensure fair and equitable access to housing. In this blog post, we’ll delve into the functions of HUD and how they impact mortgage lending practices.